X-RECHNUNG CHALLENGES – THE SUPPLIERS PERSPECTIVE

The e-invoicing deployment has been steadily progressing across Germany for the last two years. Starting with the obligation for public administration to receive invoices in a defined electronic format, which was finalized in Germany in April 2019, another milestone was passed on 27th November 2020, when the obligation was extended to suppliers of public administration. The whole revolution is still pending as the current requirement is limited to federal authorities’ suppliers. However, the state administration is expected to introduce similar obligations at regional level in due course.

Let’s have a quick look into the more technical side of the e-invoicing requirement as surely it is the primary challenge that suppliers are facing, not only in Germany. Among particular challenges suppliers would need to consider are the following:

- The issuance of the X-Rechnung

- The transmission of the X-Rechnung

- The variety of administration portals

- Changes in management

Issuance of the X-Rechnung

The suppliers of public administration in Germany face a considerable challenge in making sure they meet the X-Rechnung requirement. In fact, it is a mix of a legal and technical prerequisites that must be obeyed. As far as the legal conditions are concerned, it could be assumed that even before the introduction of X-Rechnung these conditions had to be met. However, the technical element is a novelty, which in most cases cannot be managed without professional support.

First of all, and although it sounds obvious, it should be stated that the typical PDF document is not equal to an electronic invoice, even if sent electronically.

The main challenge for the issuance of the X-Rechnung is to meet all technical requirements that are part of the official schema. From a technical perspective it means that machine-readable documents must be created, generally based on a specifically designed structure; namely, an XSD file. In case of X-Rechnung the XSD structure is part of the syntaxes, which are used for the creation of X-Rechnung (UBL and UN/CEFACT). In other words, there is no separate X-Rechnung XSD.

The issuer of the invoice must ensure that the e-invoice is created according to the said structure. Once it has been created, a validation is available through the dedicated tool published by KoSIT (the official authority managing the X-Rechnung implementation) at https://github.com/itplr-kosit/validator-configuration-xrechnung. Under the validation portal the particular schemas (schematrons) are available for EU standards as well as for X-Rechnung.

It is worth mentioning that the X-Rechnung (and the wider EU) standard ensures full security in terms of compliance with tax regulations. However it does not include the electronic signature of the issuer. Although it is not required to add an electronic signature, such authentication may still raise security levels in the business.

X-Rechnung transmission

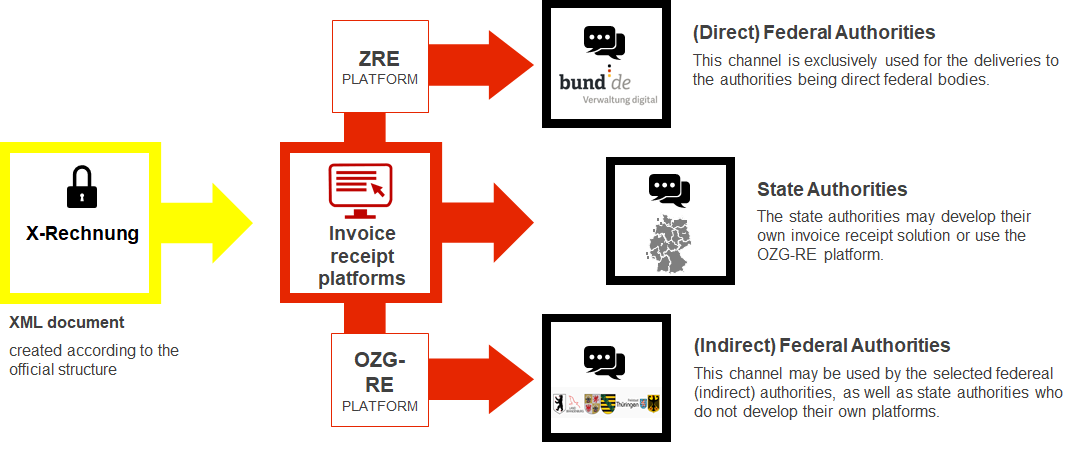

As regards the sending of the X-Rechnung to the administration operators, there are generally different ways of processing German e-invoices. The German government provides the two main platforms for the transmission of e-invoices to invoice recipients:

- ZRE (Central Invoice Receipt platform) for electronic invoices to institutions of direct federal administration (e.g. ministries and federal authorities), and

- OZG-RE (Online Access Act – Invoice Receipt platform) for electronic invoices to institutions of indirect federal administration (e.g. independent institutions that have taken on federal tasks).

However, before the supplier starts using any of the above-mentioned portals to transmit invoices to certain public clients, a one-time registration is required. Additionally, it is also required to obtain “Leitweg-ID” of the recipient, which is automatically generated and provided upon placing a new order. Again, it is the supplier’s obligation to make sure this information is provided, as the sending of the X-Rechnung will not be possible otherwise before long.

In order to process the e-invoice there are two main options on how this can be done through these platforms:

- manual data entry – this option is for suppliers who interact with public authorities on an occasional basis (low volume of transactions)

- dedicated software – this option is for regular providers that require investment in specific software (some major providers have it integrated in their offering)

The above platforms have been defined for use by the central (federal) authorities. At state level, local authorities may still use these platforms (e.g. Mecklenburg-West Pomerania, Brandenburg, and Saxony) or develop their own solution for receipt of X-Rechnungs (e.g. Baden-Württemberg, North Rhine-Westphalia, Rhineland-Palatinate, Saxony-Anhalt, and Lower Saxony).

For a supplier, it may be a challenge to follow state-specific solutions and apply them in practice. X-Rechnung definitely uniforms the document format itself but the availability of several solutions regarding the receipt of e-invoices may be considered demanding (as states also apply various exemptions based on the transaction threshold).

X-Rechnung implementation

The changeover to electronic invoices or to XRechnung should ideally take place as a project that involves a number of departments of the company, including accounting, sales and purchasing, and of course and most importantly, IT. Keeping in mind that the technical element is the core of the change, it is of the highest importance that the relevant skillset are available within the organization. If not, a professional external provider may need to be appointed.

It should be underlined that introduction of X-Rechnung affects the whole invoicing process and requires redefinition of its management. The supplier should in particular pay special attention to all the stages of the invoicing process (issuance, verification, sending and archiving), as these most probably will be impacted. In a nutshell, the change to electronic invoicing triggers the digitalisation of the whole process of invoicing. Going even further, this is also an excellent occasion to extend the digitalisation to other transaction phases, such as order, fulfilment, transportation, etc.

In the long run, this will definitely bring numerous advantages in terms of efficiency and cost savings. However, looking at short-term planning, suppliers must be ready for a variety of challenges and issues that they will have to deal with.