Revolutionary VAT changes in B2C transactions

2021 marks a year of unprecedented changes in the EU VAT regulations. Although the legislative discussions on the “E-commerce VAT Package” began in 2017, it was not until 2021 that it caught the interest of taxpayers, service providers, and tax advisors.

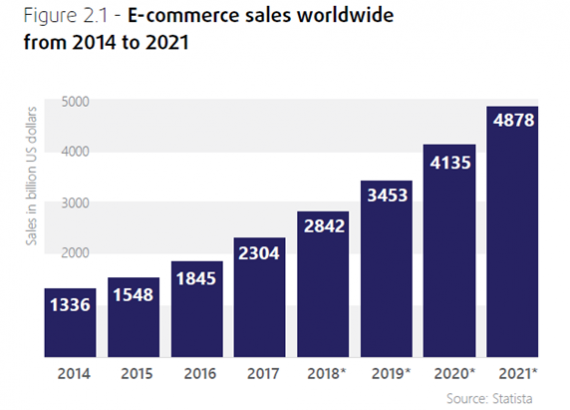

The first reason for these changes is the pace at which e-commerce sales are growing (see the chart below) along with predictions that this trend is likely to continue with even more dynamism in the coming years.

Another factor driving this change is the rate of non-compliance and fraudulent activities within the e-commerce market. The EU Commission estimates the VAT frauds in e-commerce cost member states over €5 billion in 2019. This trend has been on the rise and is expected to hit €7 billion in 2021.

E-COMMERCE SALES WORLDWIDE FROM 2014 TO 2021 (SOURCE: STATISTA)

Contents of the package

The VAT e-commerce package will introduce completely new rules for B2C transactions within the EU. The general aim is to simplify the e-commerce trade and eliminate fraudulent activities and increase the VAT revenue across the EU member states.

Some of the results of this measure are:

- An improvement in the existing Mini One Stop Shop (MOSS) regime

- New obligation for online marketplaces, which will have to install electronic interfaces

- Significant change to rules for suppliers of services (other than TBE) to individuals (B2C)

- Significant change to rules for distance sales transactions

- Exemption removed from distance sale of imported low-value goods (€22)

New obligations that apply after 1st July

The majority of the regulations are for distance sale transactions, which have been considered extremely burdensome in terms of VAT compliance.

New distance sale threshold

The new distance sale threshold constitutes the most eminent change of the E-commerce VAT Package. Before the change, online sellers had to verify and apply country-specific thresholds (ranging from €35,000 to €100,000), whereas as of 1st July 2021 they must observe a single €10,000- threshold applicable on total sales in all EU countries (excluding seller’s country of establishment). The single, pan-EU distance sale threshold simplifies the regime but, most importantly, once the threshold exceeds the VAT registration and compliance requirements of the consumer’s country, it will be fulfilled.

VAT-OSS procedure (extension of MOSS)

This procedure will allow the simplification of VAT compliance obligations for online sellers. Under the new regime, it will be possible to avoid VAT registration and VAT compliance in multiple countries. The seller may choose to declare and settle VAT in a single jurisdiction and in a single VAT declaration.

Distance sale of imported low-value goods

The biggest novelty is the removal of the VAT exemption for low-value goods imports. This regulation has been immensely abused by non-EU suppliers. As of 1st July 2021, the goods imported into the EU and delivered to consumers will always be subject to VAT. There will be different ways to collect and settle VAT. However, the main idea is to ensure effective implementation of VAT on all such supplies.

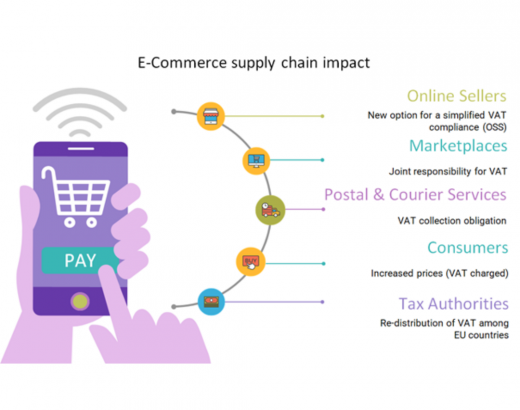

Affected stakeholders

The new regulations apply to all stakeholders in the e-commerce business, and in particular to B2C suppliers, e-commerce platforms (operators), freight forwarders (couriers), and individual customers.

B2C suppliers will have to consider various new obligations arising from the changed distance sale regulations. The most important change was the introduction of a single EU-wide threshold of €10,000 in place of country-specific thresholds.

This will speed up the process of registering for VAT in various jurisdictions, compared to the former regime.

This simplified option has been introduced to ensure distance sellers account for and settle VAT in one jurisdiction. This new possibility is known as One Stop Shop (OSS) and remains optional for taxpayers (meaning that they can still follow the local compliance model). Still, the B2C sellers would have to take action to analyze whether using OSS is beneficial in their case.

The marketplaces are faced with a specific requirement as they are now considered responsible for VAT settlement which until 1st July 2021 has been the exclusive responsibility of the sellers.

Currently, marketplaces are jointly responsible for the collection and settlement of VAT. In practice, this means that the marketplaces will become more occupied with VAT compliance work (such as calculations, VAT registration, VAT reporting) for sellers using the marketplace.

Thirdly, postal and courier services providers are also now in the spotlight, together with the marketplaces. This is because in certain circumstances these parties are to be considered responsible for VAT calculation and collection. This would be the case if the Import One Stop Shop (iOSS) is not chosen for importing goods and B2C sales in the EU.

The new VAT collection obligation of postal and courier providers, accompanied by the removal of low-value import exemptions, ensures that goods are never delivered to a customer without VAT being paid on the transaction.

The impact on consumers is not significant on the compliance side. However, they will probably have to bear the real cost of the VAT according to the nature of this tax (consumption tax). The impact will be visible mainly for the delivery of low-value goods, which so far have often been delivered under exemption rules. The VAT compliance impact is unlikely to become a headache for consumers since the marketplaces and online shops are set to compete to provide the best customer experience.

We should remember that the tax authorities will also be impacted. If the OSS procedure is in use, local authorities will be responsible for the redistribution of VAT income to the relevant tax authorities in other EU countries.

All of the stakeholders mentioned in this article should be aware of the newly implemented rules so as to not be caught by surprise or, in the worst-case scenario, fined for non-compliance.