Norway: SAF-T based digital VAT return as of 2022

Norwegian taxpayers will need to submit digital VAT returns as of the January

2022 reporting period. The new VAT return boxes reflect SAF-T codes.

Background

Currently, standard VAT returns (which means the RF-0002 form for most

businesses) contains 19 lines divided into transaction types (whereas, there are

about 30 VAT codes in SAF-T) that have been obligatory since 2020. Norwegian tax

authorities have decided to adapt VAT return reporting through SAF-T.

Consequently, the new digital VAT return consists of fields in line with SAF-T codes.

The standard VAT reporting period in Norway is bi-monthly. Deadlines for submission

of SAF-T based VAT returns will remain the same. Taxpayers have one month and

10 days to prepare a return. As such, the first reports to be submitted according to

the new standards has to be done by April 10, 2022.

Technical outline

Currently, most of taxpayers in Norway fill in VAT return boxes manually in the Altinn

portal. However, Norwegian tax authorities (Skatteetaten) expect new digital SAF-T-

based VAT returns to be submitted directly through the taxpayer ERP system.

Similar to most new e-tax developments, files will need to be submitted to the tax

office in XML format.

The exchange of information between taxpayers and Skatteetaten is based on a

dedicated API (application programming interface). There are two APIs provided by

Norwegian tax authorities for developers: the Skatteetaten VAT return validation API,

and the Altinn3 VAT-Return-Submission API. Although Altinn will still be used for

identification and authentication, it will not be possible to upload XML files manually

through the Altinn portal.

Detailed technical documentation – including the XSD structures of the new digital

SAF-T-based VAT returns, and API descriptions – is provided by Skatteetaten on

GitHub, which is a widely known portal among developers.

The content of Norwegian SAF-T based VAT returns

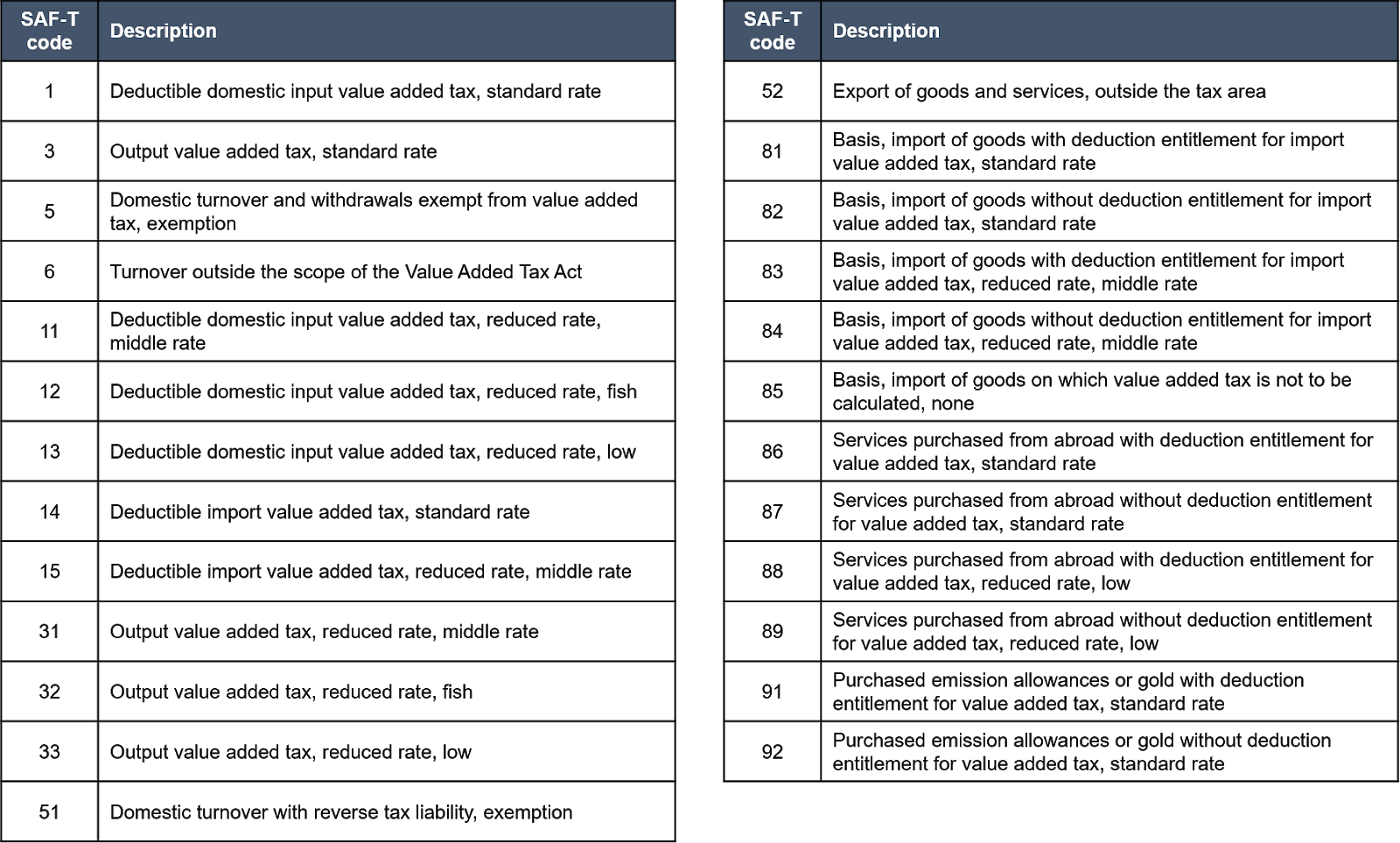

Most importantly, the logic of the new Norwegian VAT return is based on SAF-T

codes, which in XML format are labelled with with tag, mvaKode. For example, in

order to declare supplies subject to the standard VAT rate of 25%, taxpayers need to

use SAF-T code ‘3’.

In addition, it is required to provide additional data in the XML output file, such as the

net amount of transaction (XML tag: grunnlag), the VAT rate (XML tag: sats), and the

VAT amount (XML tag: merverdiavgift). It is also worth underlining that it is necessary

to provide internal taxpayer ERP tax codes (XML tag: mvaKodeRegnskapssystem),

which need to be mapped to SAF-T codes.

SAF-T codes and their use in the new Norwegian VAT returns are presented in the

below table.

Each SAF-T code can also be indicated with additional available comments in the XML tag merknad. For example, in order to indicate that a particular invoice is a credit note value, kreditnota should be entered in the merknad field. Details not covered directly by a particular SAF-T code need to be described with XML tag spesifikasjon. For instance, reversal of input VAT under SAF-T code 1 might be additionally described by value tilbakefoeringAvInngaaendeMerverdiavgift.

Next step: sales and purchase list

Norway is becoming an e-tax solution leader. SAF-T reporting is already in place. As of 2022, new digital SAF-T-based VAT returns are coming into force. However, it seems that more electronic obligations will be introduced in Norway.

Skatteetaten has announced that it is considering the implementation of some sales and purchase listings. Although details are not known yet, such reporting requirements are on a transactional level. The Control Statement used in the Czech Republic is an example of a sales and purchase listing. We have already published an article about Czech VAT Control Statements.

Prepare for SAF-T based VAT returns

There are still a few months until the arrival of the new, digital Norwegian SAF-T-based VAT returns. However, it is worth preparing for these obligations immediately. Apart from core IT development, there are other tasks that need to be performed.

Primarily, taxpayers need to map all their internal ERP tax codes to SAF-T codes. Norwegian returns, as a rule, need to be submitted directly from the ERP system. Therefore, if there are any issues with tax codes (such as a missing tax code for a particular transaction) it will no longer be possible to resolve them through workarounds (like spreadsheet manipulation).

Also, SAF-T logic makes Norwegian VAT returns more detailed than current ones. It becomes even more comprehensive when considering the obligation to report additional information such as bad debts, self-supplies (like free of charge disposals/ withdrawals), and reversals.

In order to analyse the specifics mentioned above, complex analysis of company transactions from a tax, business, and system perspective is required. Therefore, starting the Norwegian digital SAF-T-based VAT return project as soon as possible is highly recommended.