Egypt: extension of mandatory e-invoicing

In mid-November 2020, Egypt’s e-invoicing journey started. Initially, 134 companies were selected to be covered by the mandatory e-invoicing requirement. From 15 February 2021 (the second phase of the rollout), the obligation was extended to another 347 companies. All big Egyptian taxpayers are required to join the e-invoicing system by 30 June 2021.

Egyptian e-invoicing: legal background

The introduction of mandatory e-invoicing is a part of a long-term development strategy, dubbed Egypt Vision 2030, aimed in particular at the digitization of government services.

The main legal development has been the setting up of a general framework for mandatory e-invoicing through resolution 188 of the Egyptian Ministry of Finance. There are also two important decisions contained in resolutions 386/2020 and 518/202 of the Egyptian Tax Authorities (ETA). They impose e-invoicing obligations on 134 and another 347 large companies accordingly. Businesses covered by the requirement include global corporations, such as Nestle, Huawei, and Procter & Gamble.

A statement by the head of the ETA, Mr Reda Abdel Kader, is worth underlining. He points out that from July 2021 companies not using e-invoicing will not be allowed to do business with public bodies, such as ministries, public sector companies, and state agencies.

Additionally, starting from January 2022, claiming tax deductions or tax refunds based on paper invoices will not be possible. A new paragraph (no 38) has been introduced to Egypt’s VAT law.

Egyptian e-invoicing: requirement overview

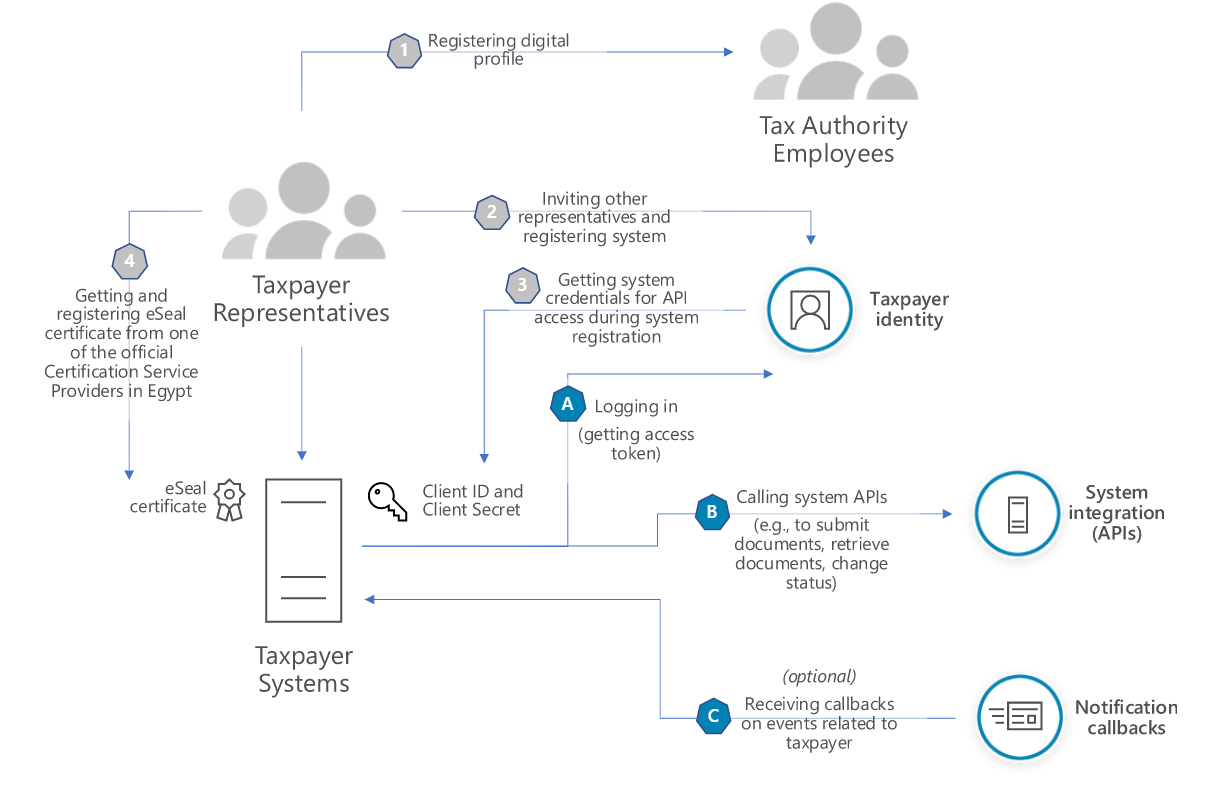

Egyptian e-invoicing follows a clearance model. In this scenario it is required to receive pre-approval from the tax authorities before being able to issue an invoice to a customer. Consequently, the ETA receives information about taxpayer invoices in real time.

The integration between taxpayer ERP and the Egyptian government e-invoicing system is facilitated by various available APIs (Application Programming Interfaces).

The required format for Egyptian invoices is JSON or XML. However, apart from JSON and XML submissions, issued invoices have to be digitally signed (through an eSeal certificate). The signature has to be done using either HSM (hardware security model) or a USB token. HSM is a physical device that ensures that crucial cryptographic data is not stored on the internet.

Egyptian e-invoicing: invoice codes

What uniquely identifies an Egypt e-invoice is the UUID (Unique ID) assigned to each issued invoice. The UUID is unique at the entire e-invoicing system level and is different from the internal taxpayer sequential invoice number.

Apart from standard pieces of information (seller, buyer, values) it is required to provide special product codes based on the Global Product Classification (GPC). GPC is a standard defined by the GS1 organization.

Additionally, there are other codes available, which Egyptian taxpayers need to use in certain situations. For example, apart from VAT there is a number of other taxes that may be stated on the invoice. Those taxes have special codes that need to be provided in the e-invoice. T1 stands for VAT, T2 for table tax (percentage), and T6 for stamping tax (amount). There are subtypes of taxes in place that also have their own codes.

Each code used by a taxpayer needs to be reflected in the system in order to be captured on the e-invoice. Therefore, detailed analysis of data mapping, and business models and transactions is required.

Egyptian e-invoicing: e-invoicing best practices

The introduction of Egyptian mandatory e-invoicing seems to be very well planned. The implementation is designed over just a few phases, starting with the largest companies. Also, the ETA supports taxpayers in meeting e-invoicing obligations in Egypt. For example, it has launched a special helpline (that can be reached on +20 16395) is dedicated exclusively to e-invoicing queries. Additionally, developers can view detailed technical documentation, which is provided in dedicated SDK.

All this support is contributing to the success of Egyptian e-invoicing. Recently, the Egyptian Minister of Finance, Mr Mohamed Maait, underlined that 1.25 billion e-invoices have already been processed. What is more, in addition to the companies that were forced to join the e-invoicing initiative, another 37 businesses decided to start using e-invoicing voluntarily.