BREXIT SERIES CHAPTER 3 – SPECIAL STATUS OF NORTHERN IRELAND

Brexit has finally taken place, bringing with it a number of issues businesses across the European Union and within the UK must grapple with. Among these is the uncommon situation that is the status of Northern Ireland. Temporarily, Northern Ireland will remain a part of the EU for VAT purposes.

Northern Ireland forms part of the United Kingdom from an administrative point of view. However, its location as a part of the Irish island makes it a quite distinct and separate part of the country. Being physically detached from the rest of the UK while being tangibly connected to Ireland has always created challenges. In a post-Brexit world these challenges have become more severe, at least from a tax point of view, to learn more about VAT consequences after Brexit, you can view our previous article.

The NI Protocol

From the physical territory point of view, Brexit brought about a completely new situation where Northern Ireland, being contiguous with the Republic of Ireland, would have to introduce a physical border and implement customs procedures for crossing this border as a result of the dissolution of the customs union. In order not to disrupt the existing trade flows, a special arrangement has been made between the EU and the UK called the Northern Ireland Protocol (NI Protocol), which came into force on 01 January 2021.

The NI Protocol aims to meet the needs of all parties affected by Brexit. It serves to avoid the establishment of a hard border between Northern Ireland and the Republic of Ireland, while at the same time allowing goods from Northern Ireland access to the GB market. It also ensures that the integrity of EU trade is maintained. This is achieved by assigning special status to Northern Ireland.

Temporary status of Northern Ireland

Based on the NI Protocol, until the end of 2024 Northern Ireland will be treated as a member of the European Union for VAT purposes. This rule applies only to commodity transactions (services will not be affected).

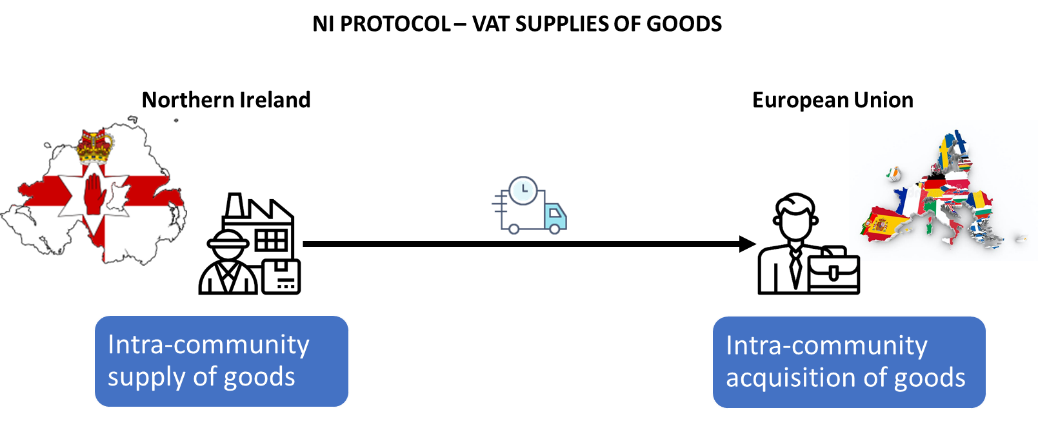

As a result, the EU VAT rules will apply to the supply of goods between Northern Ireland and EU countries. In particular, EU types of transactions, that is, intra-community supply/intra-community acquisition, shall still be recognized as trade between the EU and Northern Ireland.

For the supply of goods between Northern Ireland and Great Britain, the delivery of goods will ultimately be recognized as export/import. However, within the transitional period they will continue to be treated as local supply (i.e., in the same way as in the pre-Brexit period).

The NI Protocol presumes that the temporary status of Northern Ireland may be extended for future years, beyond 2024.

Goods transactions between Northern Ireland and EU

Based on the NI Protocol, transactions between Northern Ireland and the EU shall continue to be treated as they were before 01 January 2021. In particular, where goods are dispatched from Northern Ireland to the EU or in the reverse direction, these transactions shall be recognized as intra-community transactions (intra-community supply/acquisition).

Because these transactions still must be reported as intra-EU transactions, for which VAT numbers must be provided, it has been decided that tax-payers resident in Northern Ireland shall be assigned the new country prefix “XI”. As of 01 January 2021 the VAT ID numbers of these businesses have been changed by replacing the “GB” prefix with “XI” (the numeric part remains unchanged). At the same time, the VIES database has been updated and now includes an additional position, “XI – Northern Ireland”, while the UK position has been deleted.

SCHEME 1 – transactions between Northern Ireland and the European Union

Goods transactions between Northern Ireland and the UK

It should be noted that there is a certain distortion in how transactions between Northern Ireland and the UK will be treated. The NI Protocol made clear that GB-NI transactions should be treated as imports and exports as of 01 January 2021. However HMRC is relying on existing flexibilities within the EU VAT rules (Articles 201 and 211 of Directive 2006/112/EC ), and intends instead to treat GB-NI transactions as regular domestic UK VAT transactions where UK output and input VAT will appear.

The official policy paper available on the HMRC website (Published 26 October 2020)[1] states that the NI-UK transactions shall generally include output VAT (at the relevant rate), which shall be claimed as input VAT by the buyer. However, there will be number of exception rules, including for supplies under a special customs procedure and supplies subject to domestic reverse charge rules (sales of gold, gas or electricity).

SCHEME 2 – transactions between Northern Ireland and the United Kingdom

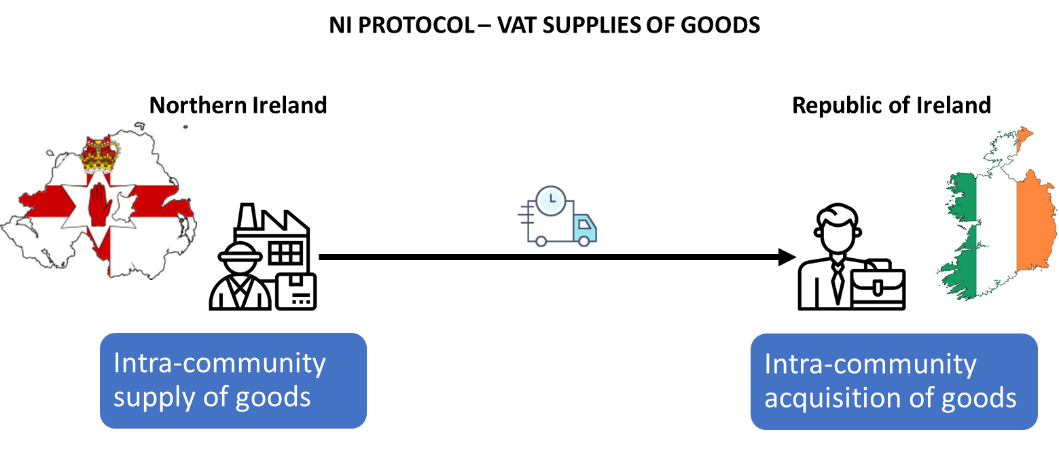

Goods transactions between Northern Ireland and the Republic of Ireland

As mentioned, the NI Protocol requires that Northern Ireland maintain the EU VAT rules for goods, but not services. To better understand the new approach towards goods transactions as one of the VAT related consequences, you can view another article we discussed earlier on the subject. Therefore, effectively, there will be no change to the current VAT rules with respect to goods exchanged between the Republic of Ireland and Northern Ireland. The only difference shall be that Northern Ireland taxpayers will be required to use an “XI” prefix in front of their VAT registration number for the purposes of intra-community trade.

SCHEME 3 – transactions between Northern Ireland and the Republic of Ireland

The NI Protocol has created a specific situation where a particular territory (Northern Ireland) has dual VAT status. It resembles the status of some special territories (dependent territories), e.g., the Aland Islands (Finland), the Canary Islands (Spain) and French islands. These territories are part of the administrative territories of particular EU countries, but may have different VAT statuses, and often are treated as non-EU territories.

[1] https://www.gov.uk/government/publications/accounting-for-vat-on-goods-moving-between-great-britain-and-northern-ireland-from-1-january-2021