SII – reporting scope extension as of 2021

As of January 2021 Spanish taxpayers have to provide to tax authorities (AEAT) with more details about their VAT transactions as the SII reporting scope will be extended. Changes include new obligations for providing data about transactions following a simplified stock movement regime, the introduction of additional fields, and a number of data validation checks.

Call-off stock movements to be reported in SII

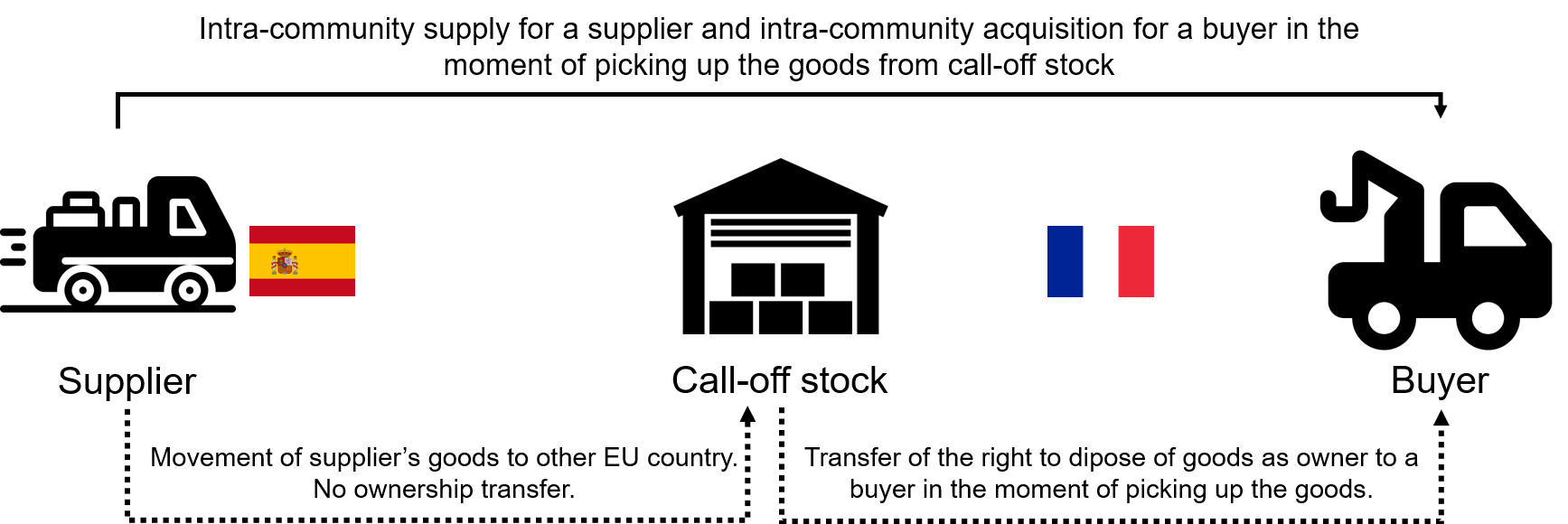

One of the solutions covered by the Quick Fixes package, which came into force in 2020, is concerned with harmonizing the VAT treatment of call-off stock movements within the European Union.

According to the Quick Fixes rules, the movement of own goods from one EU member state to call-off stock located in another EU country does not count as deemed intra-community supply of goods (departure country), or deemed intra-community acquisition of goods (arrival country) for a supplier. Instead, a simplified call-off stock arrangement allows for the postponement of recognizing the standard intra-community supply of goods for a supplier, and standard intra-community acquisition for a buyer at the moment of collecting the goods from the call-off stock. Thanks to the Quick Fixes package, suppliers transferring goods to call-off stocks in other EU countries do not need to register for VAT purposes in the member state in which the call-off stock is located.

Starting from January 2021, stock transfers covered by the Quick Fixes simplified call-off stock arrangements will have to be specially reported to SII. There is a number of new fields introduced in the new SII scheme, dedicated to call-off stock movements. In practice, there is a new so-called book (LRVC, or Libro de venta de bienes en consigna) created for reporting call-off stock movements.

New fields and data validations in SII

Apart from reporting obligations about call-off stock movements, there are additional changes in SII applicable as of January 2021. Firstly, new fields have been introduced. In particular, if a taxpayer decides to deduct input VAT in a later period, they need to fill in three additional fields:

- DEDUCIR EN PERIODO POSTERIOR (Deduction in later period) – to be marked with SI (YES);

- EJERCICIO DEDUCCIÓN (Year of deduction) – a year of (later) deduction needs to be provided;

- PERIODO DEDUCCION (period of deduction) – a period of (later) deduction needs to be provided (either by month or by quarter).

In order to improve the quality of data provided in SII, the Spanish tax authorities (AEAT) have decided to implement a significant number of new comprehensive validations over SII data.

For example, in the book of issued invoices the following check is conducted:

If the invoice issued does not contain VAT and is subject to reverse charge (TIPO NO EXENTA = S2 or S3), then a customer has to be identified by NIF (Numero de Identificacion Fiscal). Other than this, the only acceptable invoice types (CLAVE DE TIPO DE FACTURA) for S1 and S2 are F1 (standard invoice), and R1 to R4 (various credit notes);

There are many more, similar validations introduced in new SII, which applicable as of 2021. They mostly reflect VAT logic and rules. For instance, there is a validation that does not allow the marking of an invoice as subject to reverse charge if it already follows the cash-flow regime (07 RÉGIMEN ESPECIA).

All validations are described in the presentation available on the AEAT website. It is worth familiarizing yourself with those checks in order to avoid mistakes in the data submitted to tax authorities.

Who should be prepared for SII changes?

Definitely, the biggest impact of new SII version will be on businesses that trade in simplified call-off stock schemes. Those entities will have to significantly increase the scope of VAT data to be reported in SII.

However, all other taxpayers need to be prepared for 2021’s SII changes as well. Most importantly, submitted files will have to be in line with the new technical SII structure (version 1.1.). Therefore, an update of the IT solutions that generate SII files is required.

Also very important is a big set of data checks on SII data, which is newly introduced. Although final validations will be performed by the AEAT, it is recommended to implement and perform checks following SII checks before sending data to tax authorities. Otherwise, there is a risk of submitted data being rejected by SII and, in a worst case scenario receiving penalties for inaccurate reporting (0.5% of invoice value/ 1.0% of mistake value).