Italy – changes in e-invoice layouts as of October 2020

The Italian VAT system contains interesting and unique solutions. Some of them are beneficial for taxpayers. For example, the concept of the so-called habitual exporter allows companies which significantly trade internationally to purchase products without VAT.

On the other hand, Italy has always been considered a country with highly demanding reporting requirements. The best-known VAT obligation is an invoice clearance model, introduced in 2019 for B2B transactions (formally, B2C as well). A similar requirement has also been in place for B2G supplies since 2015.

In practice, it is mandatory to issue an e-invoice in XML format for B2B & B2G deliveries between Italian taxpayers. However, the main requirement is to send the invoice to tax authorities before sending it to the customer. There are a number of validations (checks) performed on the invoice. Only if the invoice passes them is it sent to a customer. The transmission of invoices has to be done via Sistema di Interscambio (SDI).

The technical structure of Italian electronic invoices (their “layout”) is described, as mentioned, in XML language. The most commonly used naming is Fattura for B2B and B2C supplies, and Fattura PA for B2G transactions. There are significant changes upcoming for aforementioned structures, as of October 2020. Let me present an overview of those amendments in this text.

Fattura & Fattura PA changes – deadlines

Primarily, the new layout of Italian e-invoices was planned to enter into force in May 2020. However, due to the COVID-19 pandemic, the deadline has been extended accordingly:

- From 1 October 2020 to 31 December 2020, usage of new Fattura & Fattura PA will be optional. In other words, it will be possible to transmit via SdI “old” versions, as well as new ones;

- From 1 January 2021 taxpayers will be required to use only new versions of e-invoices.

The above deadlines are based on 166579/2020 Agenzia Entrate (Italian tax authorities) order.

Fattura & Fattura PA – overview of changes

The new specifications for Fattura are labelled as 1.6.1. Fattura PA – 1.3.1 accordingly. Both structures contain a number of significant changes. The majority of them are similar both for Fattura and Fattura PA, which is why we are presenting them together.

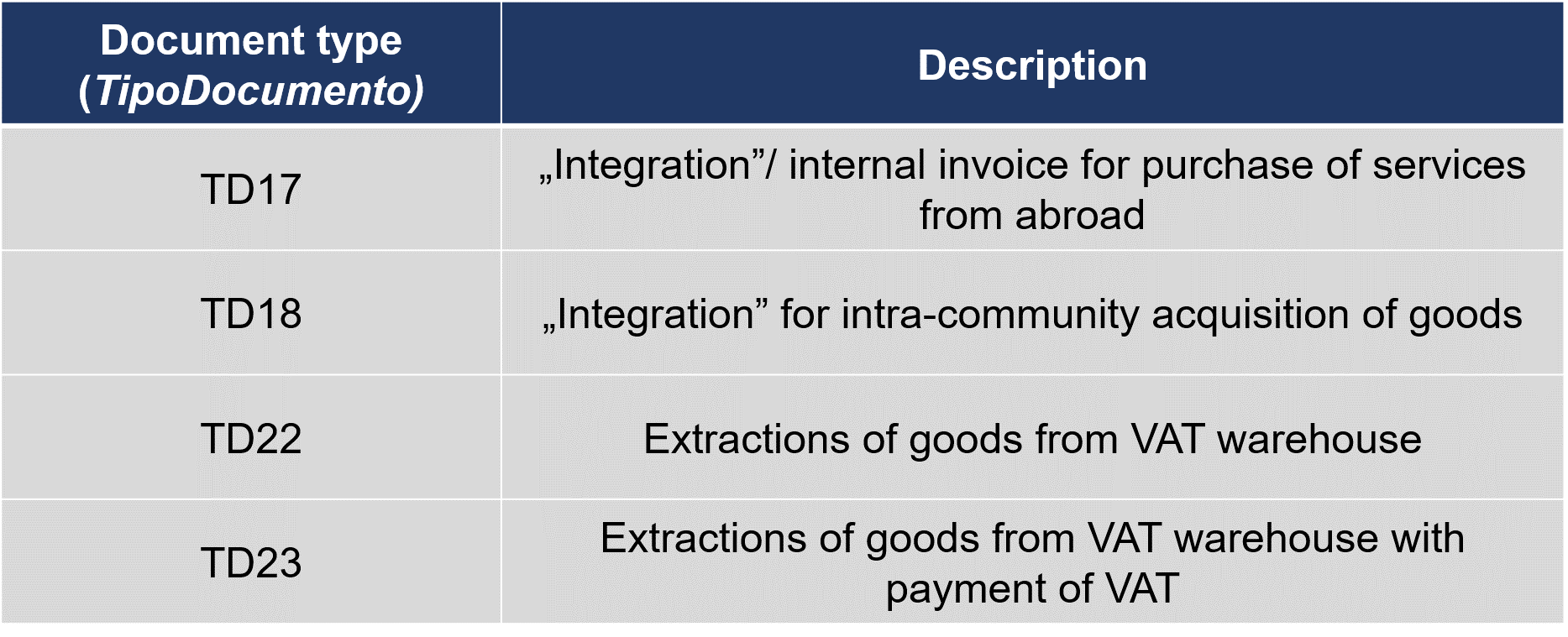

One of the main changes is related to adding a number of new possible values of the field TipoDocumento (Document Type). In this field the type of document transmitted needs to be entered. For example, TD01 value means a standard invoice, TD04 – a credit note.

An overview of the selected new document types is presented below.

Codes TD17 & TD18 are especially noteworthy. In Italy, there are very complex rules regarding registering invoices from foreign vendors. It happens, that so-called internal invoices (autofattura) are still required. The taxpayer has to issue an invoice for himself, for example in the case of purchasing services from non-EU vendors. When buying services or goods from EU vendors, it seems that only so-called integration (integrazione) is required. In simple words, it results in reverse-charge settlements in Italy. In the previous version of Fattura, invoices from foreign vendors were not captured in SdI. Right now, because of introduction of TD17 & TD18 it is the buyer’s responsibility to register particular purchases in SdI (above mentioned – integration). It will result in an increase in the scope of reporting.

Another important change in the Fattura & Fattura PA structure is extension of possible Natura (Nature) codes. This field needs to be filled if an invoice does not contain VAT. A particular code provides a relevant reason for not adding VAT on the invoice. The change is for instance, in the case of N6 code. Before, that code was applicable for each type of reverse charge transactions. As of January 2021, this code will no longer be allowed. Instead, N6.1 – N6.9 codes are introduced which more precisely describe the nature of reverse-charge. For example, N6.1 is valid for supply of scrap, whereas N6.5 is for transactions in mobile phones.

In Italy it is common that invoices indicate taxes other than VAT. For instance, local withholding tax or other restraint taxes or contributions may appear on invoices. There is a change related to the field which describes this type of taxes in Fattura & Fattura PA layout. The field is called TipoRitenuta (withholding type). Four new codes are introduced RT03 – RT06. For instance, RT03 is applicable for INPS (Istituto nazionale della previdenza sociale) contribution, which is a kind of social security/ pension system in Italy.

There are more amendments introduced, often of a technical nature. For instance, it is no longer mandatory to provide the amount of so-called bollo. This is a kind of stamp duty which needs to be paid instead of VAT (in case invoice does not contain VAT). The value of bollo is always equal to EUR 2. Therefore, there was no need to keep the field mandatory.

The above changes are only selected ones which we found most relevant, as they would require effort from taxpayers. They are not only related to core IT development, but tax and accounting departments will also need to map out\ new document types or nature codes for company transactions.