E-Invoicing Revolution In Vietnam

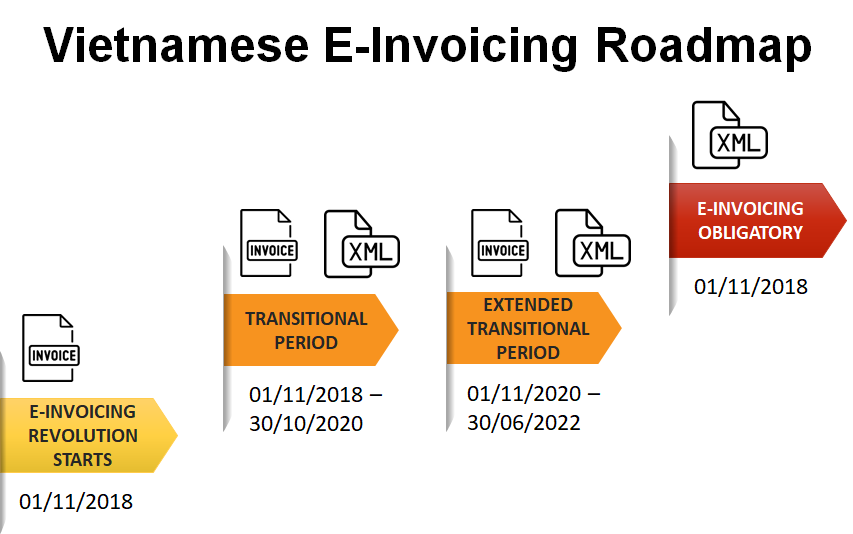

Initially planned to be introduced on 1st November 2020, the e-invoicing mandate in Vietnam has now been delayed until July 2022. The lack of readiness communicated by various sectors triggered the government’s decision on the postponement of this regulation.

Still, please note that even before the extended deadline, some businesses will already be obliged to implement e-invoicing regulations. The tax administration will notify selected businesses and request them to use e-invoices that meet the technology and infrastructure requirements prescribed by the law. At the same time, there may still be some exclusions available, even on 1st July 2022. However, these should be single extraordinary cases, keeping in mind that the main goal is to switch from paper to 100% e-invoicing in Vietnam by the said date.

Finally, the government encourages companies, organizations, and individuals that meet e-invoicing conditions to apply regulations on electronic invoices before 1st July 2022.

LEGAL BACKGROUND OF E-INVOICING IN VIETNAM

The Vietnamese e-invoicing requirement has been regulated in the Decrees 51/2010/ND-CP dated to 14th May 2010, and No. 119/2018/ND-CP dated to 12th September 2018. More detailed guidance on the application of the e-invoicing regulations has been included in Circular 68/2019/TT-BTC.

However, the government has just issued Decree No. 123/2020 /ND-CP, dated 19th October 2020, on invoices and documents. It states that the obligation will come into force only in July 2022. Accordingly, paper invoices will only be used until the end of June 30, 2022, from July 1, 2022, officially applying electronic invoices. Still, the basic regulations mentioned will remain in force.

VIETNAMESE E-INVOICING CONCEPT

The Vietnamese government has designed a dual concept where two types of e-invoices are prescribed (with and without a verification code).