BREXIT SERIES CHAPTER 1: OVERVIEW OF VAT CONSEQUENCES

Although Brexit was finally realized on 1 February 2020, there was a transitional period until the end of 2020, ensuring that the United Kingdom (UK) would be treated the same as other European Union Member States for VAT purposes.

However, from January 2021 the UK was no longer part of EU VAT area and therefore not bound by EU VAT Directive regulations. This causes a number of serious VAT-related consequences, particularly regarding changes in goods transactions.

With this article, we start our SNI Brexit Series of four articles about the VAT implications of Brexit. This text is an overview of the most important changes, while details will be explored in the following three articles.

Focus on goods transactions

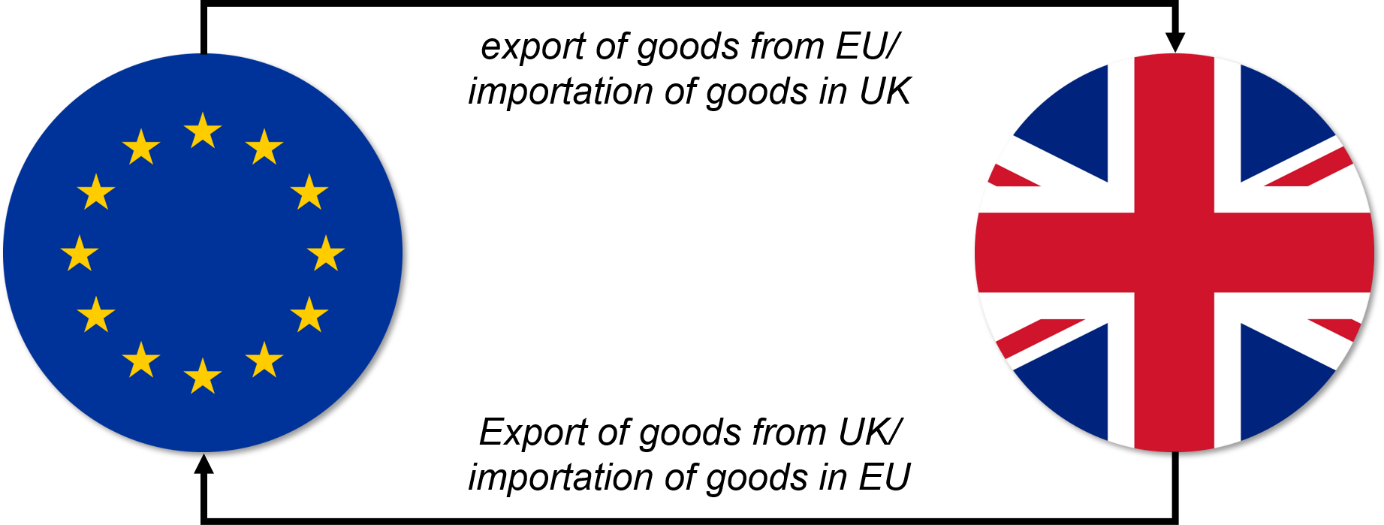

Brexit’s biggest impact on VAT regards the settlement of transactions in goods. The movement of goods between the UK and EU countries is no longer treated as intra-community supply in the case of the country of dispatch, or intra-community acquisition in the case of the country of arrival.

As the UK is recognized as a third country from the EU’s VAT perspective, the supply of goods from an EU country to the UK is recognized as an export of goods. On the other hand, bringing goods from UK to EU territory is recognized as an importation of goods.

From the UK’s perspective, supplies from the UK to other EU and non-EU countries are treated as an export of goods. Consequently, acquisitions of goods from both EU and non-EU countries are treated as an importation of goods in UK.

There are many more nuances that need to be considered regarding the transaction of goods in the UK, such as the possibility of applying simplified triangulation, or lack thereof. A detailed overview of VAT consequences in goods transactions, including analysis of transitional rules, can be found in Chapter 2 of our SNI Brexit Series.

Service transactions remain unchanged

The changes in transactions for services are not as significant as those for transactions in goods. From the EU’s perspective, place-of-supply rules remain the same. In B2B transactions, there is one main rule that governs the setting up of a place of supply in the vicinity of a recipient. There are also five exceptions: immovable property-related services, catering, short-term hiring of means of transport, passenger transport, and admission to events. Also, it seems that the UK is not going to change its place-of-supply rules for service transactions. Therefore, they will be based on those of the EU.

Special status of Northern Ireland

The United Kingdom of Great Britain and Northern Ireland consists of four countries: England, Scotland, Wales, and Northern Ireland.

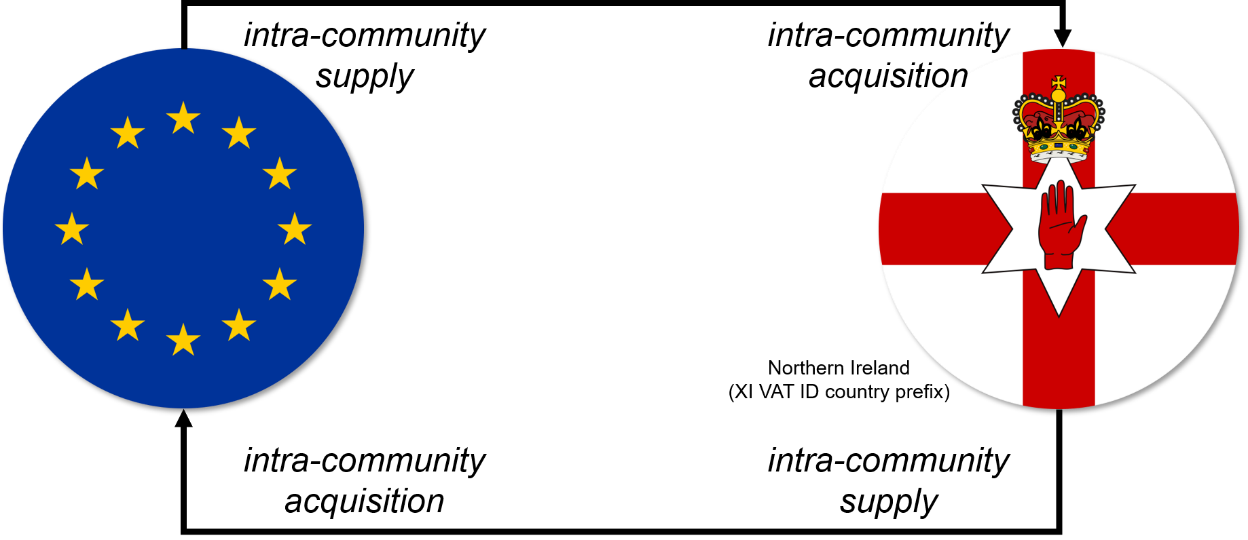

It is Northern Ireland that has a special status on VAT grounds. Although Northern Ireland is part of the UK, at least until the end of 2024, goods transactions between EU countries and Northern Ireland will follow EU VAT rules, including those governing the intra-community supply of goods and intra-community acquisition of goods.

For example, the supply of goods from Germany to Northern Ireland will be recognized as an intra-community supply of goods in Germany, and thus subject to 0% rate (if relevant conditions are met). A purchaser from Northern Ireland will need to settle VAT using a reverse-charge mechanism, as the transaction will be recognized as intra-community acquisition of goods.

Northern Ireland also has a separate, brand-new VAT ID country prefix: XI. This prefix is valid for intra-community transactions and can be checked in the VIES database.

More details about Northern Ireland’s VAT status cover, for example, transactions between the rest of UK and the Northern Ireland, which will be published in Chapter 3 of our SNI Brexit Series.

Changes in administrative and compliance obligations

Brexit’s impact on VAT compliance and administrative obligations is quite significant and affects many areas. Primarily, UK companies that want to register (or are already registered) for VAT purposes in EU countries may be required to appoint a fiscal representative. That would definitely result in increased compliance costs for UK businesses.

As transactions in goods involving the UK will generally be treated as export/import (instead of intra-community supply/ acquisition), a potential impact on cash-flow might be faced in countries that do not allow for settlement of importation VAT using the so-called postponed accounting method (more or less working as reverse-charge).

Although, as mentioned, changes in VAT treatment for transactions in services are not significant, there are some important ones that apply to VAT compliance. For example, the supply of services to EU and non-EU countries is more often reported in different VAT return boxes, than supplies to EU. Also, the supply of services by an EU entity, according to the main rule, to EU countries have to be additionally reported in an ECSL report.

Furthermore, exceptions from main place of supply rule in services might result in so-called “foreign VAT”. UK businesses, as non-EU ones, will need to apply for a refund of EU foreign-VAT using the 13th Directive. (EU businesses apply via 9th Directive.) Taxpayers who want to receive a refund of UK VAT will need to obey local UK regulations with respect to foreign VAT.

More comprehensive analysis of VAT compliance and administrative changes caused by Brexit will be presented in Chapter 4 of our SNI Brexit Series.