Switzerland – Electronic VAT Return Filling from January, 2021

Electronic VAT reporting is becoming mandatory in many countries. However, there are countries that still largely rely on paper reporting. For example, in Switzerland only about 50% of taxpayers submit their VAT returns electronically. On January 2021, e-filling of Swiss VAT returns will become mandatory.

The Swiss VAT System

The general concept of Swiss VAT is similar to the EU harmonized VAT model. Still, there are some important differences, as Switzerland does not need to follow EU VAT Directive regulations. For example, the EU does not allow standard rates of lower than 15%. In Switzerland, however, the standard rate is 7.7%.

Worth mentioning is the so-called “VAT union” between Switzerland and Liechtenstein. For VAT purposes both countries are considered to be one domestic territory. However, related companies based in Switzerland and Liechtenstein cannot be members of the same VAT group.

E-filing via ESTV SuisseTax

The main method of electronic VAT return filing in Switzerland is via ESTV SuisseTax, which has been in place since 2015. This is a service run by the Swiss tax authorities, the ESTV (Federal Tax Administration). It requires one-time registration of a taxpayers in order to receive access to the system.

ESTV SuisseTax allows taxpayers to import VAT return data from an XML file, which is a common standard in electronic tax reporting. The accounting data might be generated directly from the taxpayer ERP system. However, it seems that the generated XML file still needs to be manually uploaded to ESTV SuisseTax. It is expected that a suitable interface (for instance, webservice) that will allow direct filing from the ERP system will be introduced by the end of 2021. Once the XML file is uploaded, a taxpayer still has a possibility to manually change some VAT return values, if required.

Apart from the filing itself, the ESTV system has some other useful features. These include the possibility to correct previous VAT returns directly in the system, and to make requests for deadline extensions, among others.

E-filing via MWST-Abrechnung easy

The new option for e-filing will be introduced starting January, 2021. It is called MWST-Abrechnung easy (VAT return easy). Compared to ESTV SuisseTax, MWST-Abrechnung easy seems to be designed for relatively small taxpayers and has limited functions. In particular it is not possible to upload XML files using the new system. On the other hand, taxpayers do not need to register in order to use MWST-Abrechnung easy. Access will be provided through special codes sent to taxpayers’ mobile phones. It is important to note that the mobile phone number has to be Swiss, not foreign.

Swiss VAT return challenges

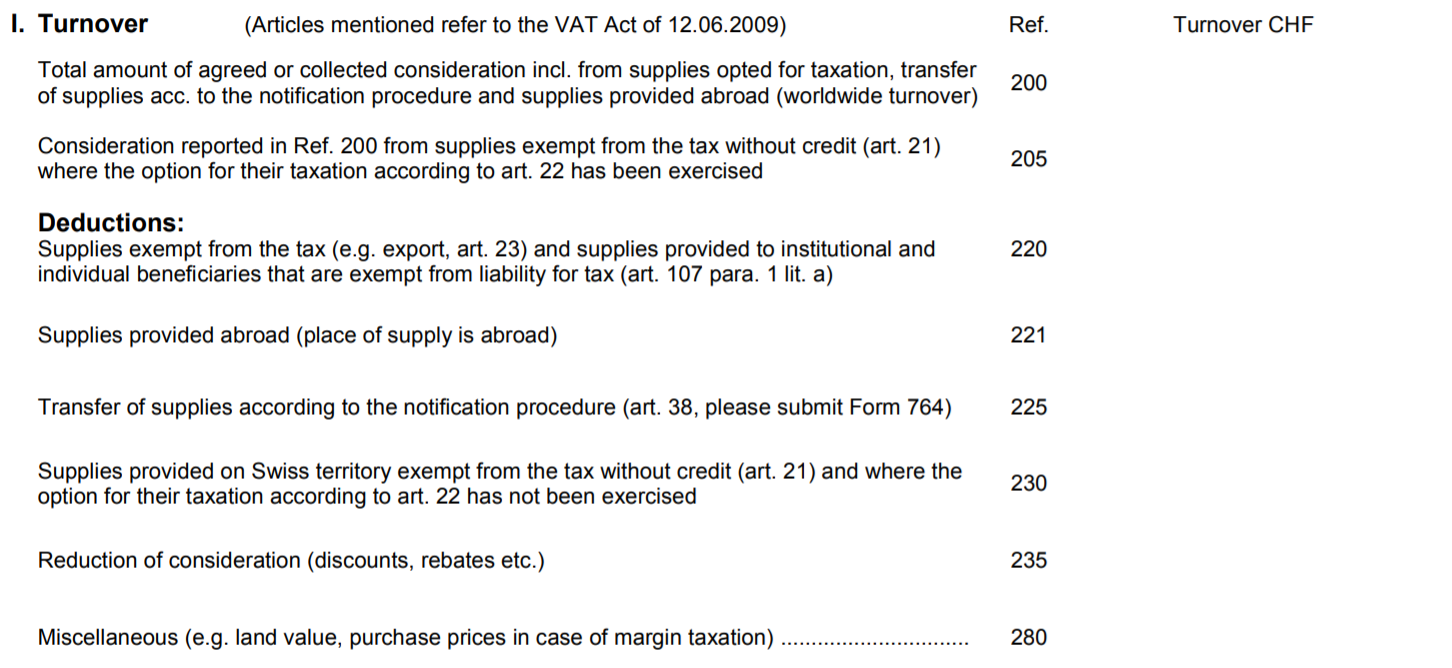

Part of Swiss VAT return template. Ref. 200 includes company worldwide turnover.

The default VAT return submission period in Switzerland is one quarter. The return has to be submitted to tax authorities within 60 days after the reporting period.

Swiss VAT returns contain a number of standard boxes in which a taxpayer reports values of its transactions performed in a particular period. For example, local supplies under applicable VAT rate.

However, what is unique to the Swiss system is a requirement to provide the global turnover of a business. For instance, if a company based in Switzerland is also registered for VAT purposes in Germany, all supplies performed under the German VAT number also have to be included in the Swiss VAT return, even though they are not taxable in Switzerland.

The aforementioned obligation may cause some challenges for taxpayers operating in multiple jurisdictions. In order to fill the Swiss VAT return, they need to consider the value of the operations in all countries in which they operate.

VAT e-filing becomes worldwide practice

Electronic filing of VAT returns is mandatory in many countries. EU examples include Finland, Spain, and Germany. Most often, tax authorities present the possibility of uploading XML files with VAT return values. That seems to be the recommended approach, as a lot of new, detailed VAT reporting requirements (SAFT, SII) are XML based.

Also worth mentioning are electronic tax developments of non-European countries, which are often very advanced. For example, Egypt and Indonesia have a so-called ‘tax clearance model’ in place, meaning that each e-invoice has to be pre-approved by tax authorities before being sent to a customer.

Considering the fact that more and more countries are introducing the above-mentioned new obligations (which, by default, are electronic) it is expected that in the near future it will not be possible to file VAT returns using the standard (paper-based) approach.