Indonesia: E-Invoicing (E-Faktur Pajak)

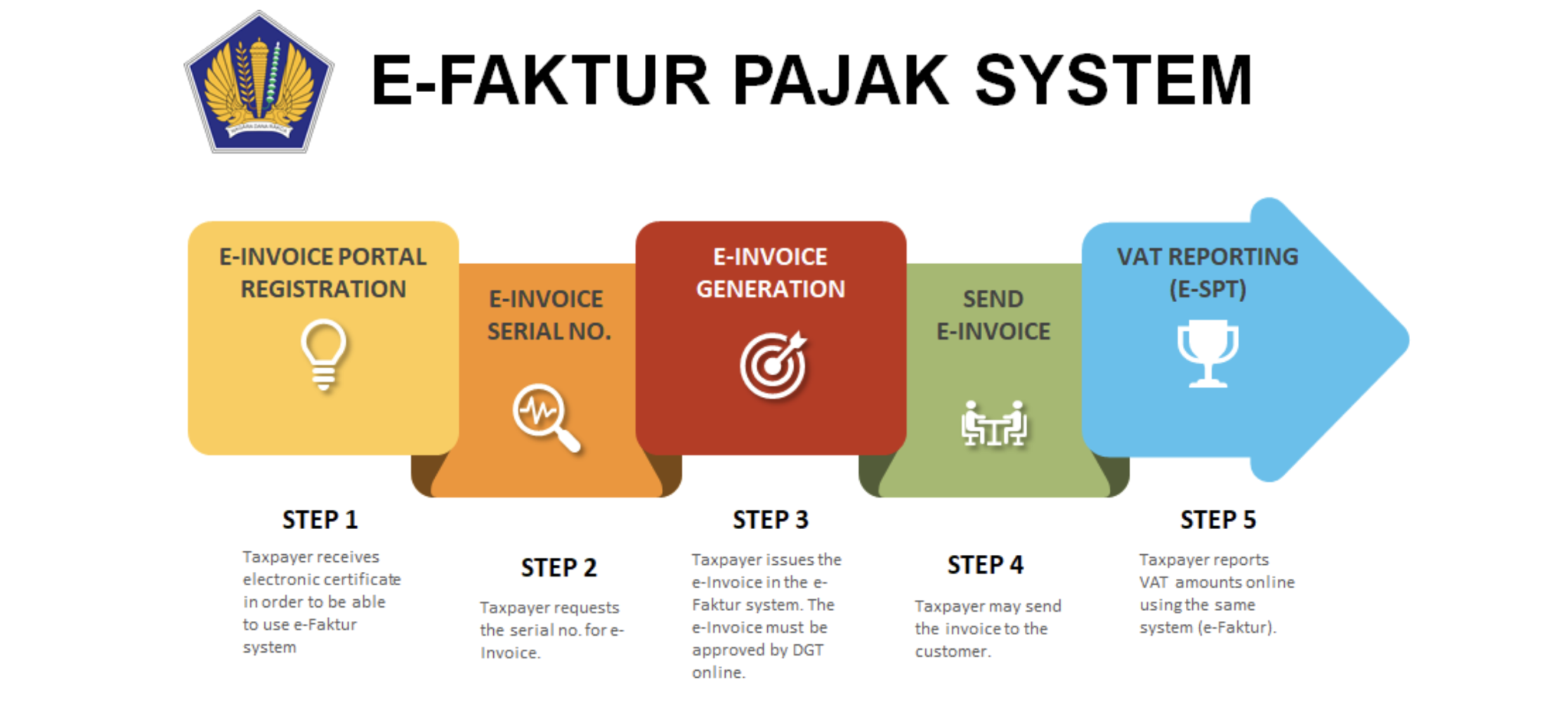

Fraud is common for VAT or similar taxes across the globe. It is widespread everywhere tax invoices are issued and used as a basis for tax settlement. Tax fraud, in particular issuance of fictitious invoices, was the reason for the introduction of the new policy in Indonesia. VAT taxpayers are now required to prepare electronic tax invoices under a prescribed process. Also, e-invoices must first be presented to the tax office before they can be further used in business transactions.

The Indonesian government introduced the electronic invoice system (e-Faktur Pajak) for the first time back in 2013. Shortly after that, on 1 July 2014, the Directorate General of Taxes (DGT) officially implemented e-Invoices with an electronic tax invoice submission feature.

Between 2015 and 2016, all VAT taxpayers were requested to implement and use the e-Faktur system. It was arranged in two stages: as of 1 July 2015, the obligation took effect for taxpayers from Java and Bali, and as of 1 July 2016 for taxpayers from other regions of Indonesia.

What is e-Faktur?

In fact, the e-Faktur is not a typical system used for e-invoicing. It is rather a facility for generating an invoice in a format determined by tax authorities. In order to issue it, the application or an electronic system managed by the Directorate General of Taxation (DGT) has to be used.

The Indonesian e-Faktur system seems to reflect the main features of a tax clearance model, in which invoices are preapproved by the tax authority before submitting it to the client. In reality, it goes a step further as it also concerns the tax reporting step.

The main feature of the system is the ability to issue electronic invoices in line with DGT requirements. In practice, this can be done by using one of three solutions available.

First, there is an e-Invoice desktop application which is an offline channel for e-invoice issuance. However, even when using this option, in order to legalize the tax invoice it is necessary to connect to the internet.

For some small-scale taxpayers, a web-based e-Invoice solution is available. This requires an internet connection but allows access to the e-invoicing portal anytime and anywhere.

Finally, the most advanced e-invoice application is the Host to Host (H2H) solution. This is mainly intended for use by larger organizations using ERPs.