Tax Digitalization Online Symposium 2022

Tax Digitalization Online Symposium 2022 was held on Thursday, March 24, between 09.30 – 13.30 (CET).

SAF-T to be on Stage In Romania: Informative Declaration D406

On Wednesday, February 2, we held a webinar on the topic of SAF-T in Romania

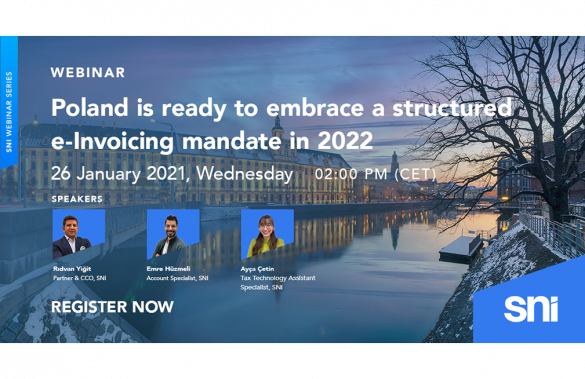

Poland is ready to embrace a structured e-Invoicing mandate in 2022

In Poland, e-Invoice will become mandatory in 2023, but Polish taxpayers can start sending e-Invoices

How will Norway’s new VAT Reporting rules come into practice?

From January 2022, Norway began implementing major changes to VAT reporting. According to the Norwegian

Last Call for New Digital VAT Return in Norway

As of January 2022, Norway will implement crucial changes to VAT Reporting. With the new

How can taxpayers adapt to the new SAF-T regulation in Romania?

Romania has made updates in its tax system and the tax authorities have announced that

Get a head start on KSA’s e-Invoicing Mandate

As of 4 December 2021, the first phase of new obligations will come into effect